I Expenses:

iExpenses is basically

an extension Oracle Payables. Employee and Contingent Worker expense reports

become supplier invoices and get paid from Payables.

You will need following responsibilities to set up Internet Expenses: Payables Manager, Internet

Expenses Setup and Administration, System Administration, Application

Developer, and AX Developer. If you are also planning on charging expense

reports to projects, you will also need Project Billing Super User and General

Ledger Super User responsibilities. You will also need access to Oracle

Workflow Builder to customize the Expenses workflow and Project Expense Reports

Account Generator.

Setups for IExpenses :

1.Define MOAC

2.Define Job

3.Define Position.

4.Define Employee.

5.Define Financial Options.

6.Define Expenses Template.

7.Define Payable Options.

8.Assign Cost Center Flexfiedl qualifier to Department segment or Costcenter segment.

9.Define Signing Limits.

10.Assign Profile Option to IExpenses Responsibility.

1.Define MOAC

- Define Responsibilities for GL, AP,PO,HRMS,IEXPENSES

- Define Business Group.

- Define Ledger.

- Define Operating Unit.

- Define Security Profile.

- Run Security List Maintenance Program.

- Assign Security Profile to Responsibilities.

- Run Replicate Seed Data Program.

2.Define Job

Navigation:HRMS --> Work structures --> Job --> Description.

Click on New button.

Enter the Job Name and Code.

Save.

3.Define Position.

Click on New button.

Enter Position number and name ,type, Organization,job,and Status of the position.

Save.

Note: If you want create more position please follow same as above procedure.

4.Define Employee.

Navigation: HRMS --> People --> Enter and Maintain.

Click on New.

Enter Employee Last name,gender,action and birth date.

Save and click on Assignments.

Enter HR Organization name,job name and Position name.

Save.

Click left lov button and select the purchase order information.

Enter the primary ledger name and default expenses account.

Save.

5.Define Financial Options.

Use the Financials Options window to define the options and defaults that you

use for your Oracle Financial Application(s). Values you enter in this window

are shared by Oracle Payables, Oracle Purchasing, and Oracle Assets. You can

define defaults in this window to simplify supplier entry, requisition entry,

purchase order entry, invoice entry, and automatic payments. Depending on your

application, you may not be required to enter all fields.

Although you only need to define these options and

defaults once, you can update them at any time. If you change an option and it

is used as a default value elsewhere in the system, it will only be used as a

default for subsequent transactions. For example, if you change the Payment

Terms from Immediate to Net 30, Net 30 will be used as a default for any new

suppliers you enter, but the change will not affect the Payment Terms of

existing suppliers.

Navigation: Payables --> Setup --> Options --> Financial.

Click on New button.

Accounting Tab:

You are required to enter defaults for the Accounting Financials Options in the

Accounting region.

Accounts Like:

Liability, Prepayment, Discount Taken.

Supplier-Purchasing Tab:

If you do not also have Oracle Purchasing installed, you do not need to enter

defaults in the Supplier- Purchasing region.

Encumbrance Tab:

If you do not use encumbrance accounting or budgetary control, you do not need

to enter defaults in the Encumbrance region.

Tax Tab:

If your enterprise does not need to record a VAT registration number, you don't

need to enter defaults in the Tax region.

Human Resources Tab:

If you do not have Oracle Human Resources installed, you are not required to

enter defaults in the Human Resources region.

Save.

6.Define Expenses Template.

Navigation: Payables --> Setup --> Invoice --> Expenses Report Templates.

Enter operating unit name,template name and enable the enable for internet expenses.

And finally enter your expenses.

Save.

7.Define Payable Options.

Navigation: Payables --> Setup --> Options --> Payable Options.

Click on Find.

Click on Expense Report Tab.

Default Template. The default expense report template that you want to

use in the Payables Expense Reports window. You can override this value in the

Expense Reports window. A default expense report template appears in the Expense

Reports window only if the expense report template is active.

Apply Advances. Default value for the Apply

Advances option in the Expense Reports window in Payables. If you enable this

option, Payables applies advances to employee expense reports if the employee

has any outstanding, available advances. You can override this default during

expense report entry.

If you use Internet Expenses and you enable this

option, then Expense Report Export applies all outstanding, available advances,

starting with the oldest, up to the amount of the Internet expense report.

Automatically Create Employee as Supplier. If

you enable this option, when you import Payables expense reports, Payables

automatically creates a supplier for any expense report where an employee does

not already exist as a supplier. If the supplier site you are paying (HOME or

OFFICE) does not yet exist, Payables adds the supplier site to an existing

supplier. Payables creates a HOME or OFFICE supplier site with the appropriate

address, depending on where you are paying the expense report. The Home address

is from the PER_ADDRESSES table, and the Office address is from the HR_LOCATIONS

table. Payables creates suppliers based on the defaults you select in this

region and employee information from the Enter Person window. You can review

suppliers and adjust any defaults in the Suppliers window.

If you do not enable this option, enter an employee

as a supplier in the Suppliers window and link the Employee Name/Number to the

supplier before you use Expense Report Export. Payables cannot export expense

reports without corresponding suppliers, and lists them on Export Results page.

Payment Terms. Payment terms you want to

assign to any suppliers that you create from employees during Expense Report

Export.

Suggestion:

Define and assign immediate payment terms for your employee

suppliers.

Pay Group. Pay Group you want to assign to any

suppliers that you create from employees during Expense Report Export. You can

define additional values for Pay Group in the Purchasing Lookups window.

Payment Priority. Payment priority you want to

assign to any suppliers that you create from employees during Expense Report

Export. A number, between 1 (high) and 99 (low), which represents the priority

of payment for a supplier.

Hold Unmatched Expense Reports. This option

defaults to the Hold Unmatched Invoices option for the supplier and supplier

site for any suppliers Payables creates during Expense Report Export.

When Hold Unmatched Invoices for a supplier site is

enabled, Payables requires that you match each invoice for the supplier site to

either a purchase order or receipt. If you enable this option for a site, then

Payables applies a Matching Required hold to an invoice if it has Item type

distributions that are not matched to a purchase order or receipt. Payables

applies the hold to the invoice during Invoice Validation. You cannot pay the

invoice until you release the hold. You can release this hold by matching the

invoice to a purchase order or receipt and resubmitting Invoice Validation, or

you can manually release the hold in the Holds tab of the Invoice Workbench.

Payables will not apply a hold if the sum of the invoice distributions by

accounting code combination is zero.

Save.

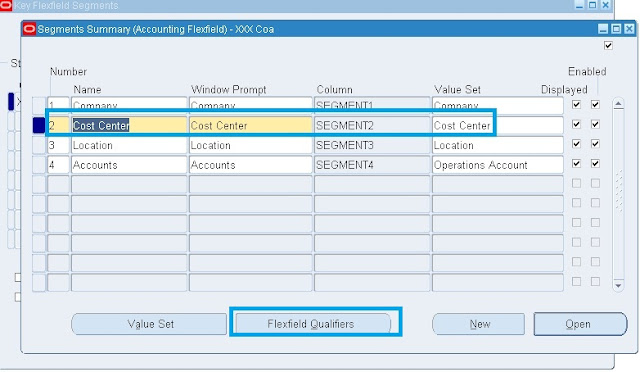

8.Assign Cost Center Flexfiedl qualifier to Department segment or Costcenter segment.

Navigation: Payables --> Setup --> Flexfield --> Key --> Segments.

Query your Coa.

Un Freeze Flexfield Definition and click on segments.

select Cost Center segment and then click on the Flexfield Qualifiers.

Enable cost center segment.

Save.

9.Define Signing Limits.

Navigation: Payables --> Employees --> Signing Limits.

10.Assign Profile Option to IExpenses Responsibility.

Navigation: System Administrator --> Profile --> Systems.

Please set the following Profile options in Site level as well as Responsibility level.