Receivables overview:

Accounts receivable is an asset account in the general ledger that documents money owed to a business by customers who have purchases goods or services on credit.

Accounts receivable can be contrasted with accounts payable, a liability account in the GL that documents money the business owes for the purchase of goods or services.

Accounts receivable, accounts payable and payroll are usually listed as the top three mission-critical business processes in a disaster recovery plan .

Receivables Workbenches:

Oracle Receivables provides four integrated workbenches that you can use to perform most of your day–to–day Accounts Receivable operations. You can use the Receipts Workbench to perform most of

your receipt–related tasks and the Transactions Workbench to process your invoices, debit memos, credit memos, on–account credits, chargebacks, and adjustments. The Collections Workbench lets you review customer accounts and perform collection activities such as recording customer calls and printing dunning letters. The Bills Receivable Workbench lets you create, update, remit, and manage your bills receivable.

Each workbench lets you find critical information in a flexible way, see the results in your defined format, and selectively take appropriate action. For example, in the Transactions Workbench, you can query transactions based on the bill–to or ship–to customer, currency, transaction number, or General Ledger date. You can then review financial, application, and installment information, perform adjustments, create a credit memo, or complete the transaction. All of the windows you need are accessible from just one window, so you can

query a transaction once, then perform several operations without having to find it again.

Receivables Setups in R12:

Overview of Setting Up:

During setup, you define business fundamentals such as the activities you process and their accounting distributions, your accounting structure, and various control features. Setup is also the time to define

comprehensive defaults that Receivables uses to make data entry more efficient and accurate. In addition, setup lets you customize Receivables to employ the policies and procedures that you use in your business.

You can set up Receivables a number of different ways. The following graphic shows the most complete setup scenario. If you use the Oracle Applications Multiple Organization Support feature to use multiple sets of books for one Receivables installation, please refer to the Multiple Organizations in Oracle Applications manual before proceeding. If you plan to use Oracle Cash Management with Oracle Receivables, additional setup steps are required.

Note: If you plan to use Multiple Reporting Currencies (MRC) with Receivables, additional setup steps are required. For more information, refer to the Multiple Reporting Currencies in Oracle Applications manual.

Related Product Setup Steps:

The following steps may need to be performed to implement Oracle Receivables. These steps are discussed in detail in the Setting Up sections of other Oracle product user guides.

Set Up Underlying Oracle Applications Technology

The Implementation Wizard guides you through the entire Oracle Applications setup, including system administration. However, if you do not use the Wizard, you need to complete several other setup steps, including:

• performing system–wide setup tasks such as configuring concurrent managers and printers

• managing data security, which includes setting up responsibilities to allow access to a specific set of business data and complete a specific set of transactions, and assigning individual users to one or more of these responsibilities.

• setting up Oracle Workflow

General Ledger Setup Steps:

The following table lists steps and a reference to their location within the Applications Implementation Wizard (AIW).

Define Segments:

Navigation: General Ledger --> Setups --> Flexfields --> Key --> Segments.

Query With Accounting Flexfield and click on New.

Give your coa name and save.

Click on Segments.

Enter your segments names.

Navigation: General Ledger --> Setups --> Flexfields --> Key -->Values.

Enter the below information and click on find button.

Enter the company values names and save your work.

Like wish define values for all reaming segments.

Define Currencies:

Navigation: General Ledger --> Setup --> Currencies --> Define.

Enter information and save.

Define Calendar Period Types:

Navigation: Setup --> Financials --> Calendars --> Types.

Enter the information and save.

Define Calendar:

Navigation: Setup --> Financials --> Calendars --> Accounting.

Save.

Define Ledger :

See My Blog how to define Ledger in R12.

Assign Ledger to a Responsibility:

Navigation: System Administrator --> Profile --> Systems.

Click on find.

Assign Ledger to GL Responsibility.

Save.

Oracle Inventory Setup Steps:

Define Operating Unit:

See my blog how to define Operating unit in R12.

Define Inventory Organization:

Navigation: Inventory --> Setup --> Organizations --> Organizations.

Click on New.

Enter information in the required fields.

Save your work and click on othres.

click on Accounting information.

Enter the required information and save.

Click on Others and select the inventory information.

Under Inventory Parameters tab enter the following information.

Under Costing Information tab enter the following information.

There are four types of transaction flexfields:

• Line Transaction Flexfield

• Reference Transaction Flexfield

• Link–To Transaction Flexfield

• Invoice Transaction Flexfield

Define Approval Limits:

Define approval limits to determine whether a Receivables user can approve adjustments or credit memo requests. You define approval limits by document type, dollar amount, reason code, and currency.

Approval limits affect the Adjustments, Submit AutoAdjustments, and Approve Adjustments windows as well as the Credit Memo Request Workflow.

Navigation: Receivables --> Setup --> Transactions --> Approval Limits.

Define Remittance Banks:

Proceed to the next step if you already defined your remittance banks in Oracle Payables. Define all of the banks and bank accounts you use to remit your payments. You can define as many banks and bank accounts as you need and define multiple currency bank accounts to accept payments in more than one currency.

Define Receivables Activities

Define Receivables Activities to provide default accounting information when you create adjustments, discounts, finance charges, miscellaneous cash transactions, and bills receivable. Receivables also uses Receivables Activities to account for tax if you calculate tax on these activities.

Navigation: Receivables --> Setup --> Receipts --> Receivable Activities.

Like wise we should define reaming receivable actives also.

Define Receipt Classes:

Define receipt classes to specify whether receipts are created manually or automatically. For manual receipts, you can specify whether to automatically remit it to the bank and/or clear your accounts. For automatic receipts, you can specify a remittance and clearance method, and whether receipts using this class require confirmation.

Navigation: Receivables --> Setup --> Receipts --> Receipts Class.

Click on Bank accounts.

Enter information in respective fields.

Save your work.

Define Payment Method:

Define the payment methods to account for your receipt entries and applications and to determine a customer’s remittance bank information. When defining payment methods, you must enter a receipt class, remittance bank information, and the accounts associated with your payment receivables type. You can also specify accounts for confirmation, remittance, factoring, bank charges, and short–term debt.

Navigation: Receivables --> Setup --> Receipts --> Receipts Class.

Define Statement Cycles:

Define statement cycles to control when you create customer statements. You assign statement cycles to customers in the Customer Profile Classes window.

Navigation: Receivables --> Setup --> Print --> Statement Cycle.

Define profile options:

Define profile options to provide default values for some Receivables operations, specify how Receivables processes data, and control which actions users can perform.

Navigation: Administrator --> Profile --> Systems.

During your implementation, you set a value for each Receivables user profile option to specify how Receivables controls access to and processes data. Receivables lets you govern the behavior of many of

the windows that use profile options.

Profile options can be set at the following levels:

• Site: This is the lowest profile level. Site level profile option values affect the way all applications run at a given site.

• Application: These profile option values affect the way a given application runs.

• Responsibility: These profile option values affect the way applications run for all users of a given responsibility.

• User: These profile option values affect the way applications run for a specific application user. The values you enter for options at the User level supersede the values that your system administrator has entered for you for these options.

Each of these user profile options affect the behavior of Receivables in different contexts. In Receivables, operations that profile options can affect include receipt application, the entry of adjustments, the creation

and remittance of automatic receipts and taxes, and posting to your general ledger.

You may also have additional user profile options on your system that are specific to applications other than Receivables.

To change profile options at the Site, Application, or Responsibility level, choose the System Administrator responsibility, then navigate to the Personal Profile Values window. Query the Profile Name field to

display the profile options with their current settings, make your changes, then save your work. You can change profile options at the user level in the Personal Profile Values window. To do this, navigate to the Personal Profile Values window, query the profile option to change, enter a new User Value, then save your work. Generally, your system administrator sets and updates profile values at each level.

Attention: For any changes that you make to profile options to take effect, you must either exit, and then reenter Receivables, or switch responsibilities.

Define Salespersons:

Define salespersons to allocate sales credits to invoices, debit memos, and commitments. If you do not want to assign sales credits for a transaction, you can enter No Sales Credit. If AutoAccounting depends on salesperson, Receivables uses the general ledger accounts that you enter for each salesperson along with your AutoAccounting rules to determine the default revenue, freight, and receivable accounts for transactions.

Define Customer Profile Classes:

Define customer profile classes to categorize customers based on credit, payment terms, statement cycle, automatic receipt, finance charge, dunning, and invoicing information. When you initially set up your customers, you assign each customer to a profile class. To customize the profile class for a specific customer, use the Customer Profile Classes window.

Navigation: Receivables --> Customers --> Profile Classes.

In Profile Class window enter the following information.

In Profile class Amount tab enter the following information.

Save your work.

Define Customers:

Define customers and customer site uses to enter transactions and receipts in Receivables. When you enter a new customer, you must enter the customer’s name, profile class and number (if automatic customer numbering is set to No). You can optionally enter customer addresses, contacts, site uses and telephone numbers. You must enter all the components of your chosen Sales Tax Location Flexfield when entering customer addresses in your home country.

Navigation: Receivables --> Customers --> Standard.

Define Remit–To Addresses:

Define remit–to addresses to inform your customers where to send payments. Associate each remit–to address with one or more state, country, and postal code combinations.

For example, if you want your customers in California and Nevada to send their payments to a specific address, enter the remit–to address and associate the states CA and NV with this address. Remit–to addresses are assigned based on the bill–to address on the transaction.

Navigation: Setup --> Print --> Remit-to-addresses.

Click on Create Remit to addresses.

Enter the required information

Click on Apply.

Enter the country name in the same page and then click on the GO.

Click on the Receipts form Create button.

Enter the following information and click on Apply button.

Accounts receivable is an asset account in the general ledger that documents money owed to a business by customers who have purchases goods or services on credit.

Accounts receivable can be contrasted with accounts payable, a liability account in the GL that documents money the business owes for the purchase of goods or services.

Accounts receivable, accounts payable and payroll are usually listed as the top three mission-critical business processes in a disaster recovery plan .

Receivables Workbenches:

Oracle Receivables provides four integrated workbenches that you can use to perform most of your day–to–day Accounts Receivable operations. You can use the Receipts Workbench to perform most of

your receipt–related tasks and the Transactions Workbench to process your invoices, debit memos, credit memos, on–account credits, chargebacks, and adjustments. The Collections Workbench lets you review customer accounts and perform collection activities such as recording customer calls and printing dunning letters. The Bills Receivable Workbench lets you create, update, remit, and manage your bills receivable.

Each workbench lets you find critical information in a flexible way, see the results in your defined format, and selectively take appropriate action. For example, in the Transactions Workbench, you can query transactions based on the bill–to or ship–to customer, currency, transaction number, or General Ledger date. You can then review financial, application, and installment information, perform adjustments, create a credit memo, or complete the transaction. All of the windows you need are accessible from just one window, so you can

query a transaction once, then perform several operations without having to find it again.

Receivables Setups in R12:

Overview of Setting Up:

During setup, you define business fundamentals such as the activities you process and their accounting distributions, your accounting structure, and various control features. Setup is also the time to define

comprehensive defaults that Receivables uses to make data entry more efficient and accurate. In addition, setup lets you customize Receivables to employ the policies and procedures that you use in your business.

You can set up Receivables a number of different ways. The following graphic shows the most complete setup scenario. If you use the Oracle Applications Multiple Organization Support feature to use multiple sets of books for one Receivables installation, please refer to the Multiple Organizations in Oracle Applications manual before proceeding. If you plan to use Oracle Cash Management with Oracle Receivables, additional setup steps are required.

Note: If you plan to use Multiple Reporting Currencies (MRC) with Receivables, additional setup steps are required. For more information, refer to the Multiple Reporting Currencies in Oracle Applications manual.

Related Product Setup Steps:

The following steps may need to be performed to implement Oracle Receivables. These steps are discussed in detail in the Setting Up sections of other Oracle product user guides.

Set Up Underlying Oracle Applications Technology

The Implementation Wizard guides you through the entire Oracle Applications setup, including system administration. However, if you do not use the Wizard, you need to complete several other setup steps, including:

• performing system–wide setup tasks such as configuring concurrent managers and printers

• managing data security, which includes setting up responsibilities to allow access to a specific set of business data and complete a specific set of transactions, and assigning individual users to one or more of these responsibilities.

• setting up Oracle Workflow

General Ledger Setup Steps:

The following table lists steps and a reference to their location within the Applications Implementation Wizard (AIW).

- Define Chart of Accounts

- Define Currencies

- Define Calendars

- Define Calendar Period Types

- Define Ledger

- Assign Ledger to a Responsibility

Define Segments:

Navigation: General Ledger --> Setups --> Flexfields --> Key --> Segments.

Query With Accounting Flexfield and click on New.

Give your coa name and save.

Click on Segments.

Enter your segments names.

and save your work.

Assign Flexfield Qualifiers to Company and Accounting segments.

Select Company segment and then Click on Flexfield Qualifiers.

Select Balancing segment qualifiers and save.

Select Accounting segment and then click on flexfield qualifiers.

Select Natural Account Segment and save.

Define Value sets:

Click on Value set.

Enter the value set Name and Size.

Save your work.

Like wise define value set for all reaming segments.

Assign Value sets to respective segments.

Save your Work.

Select Allow Dynamic inserts and Freeze Flexfield Defination and then click on Compile.

Wait untill the following program are successfully completed.

Define Values:

Navigation: General Ledger --> Setups --> Flexfields --> Key -->Values.

Enter the below information and click on find button.

Enter the company values names and save your work.

Like wish define values for all reaming segments.

Define Currencies:

Navigation: General Ledger --> Setup --> Currencies --> Define.

Enter information and save.

Define Calendar Period Types:

Navigation: Setup --> Financials --> Calendars --> Types.

Enter the information and save.

Define Calendar:

Navigation: Setup --> Financials --> Calendars --> Accounting.

Save.

Define Ledger :

See My Blog how to define Ledger in R12.

Assign Ledger to a Responsibility:

Navigation: System Administrator --> Profile --> Systems.

Click on find.

Assign Ledger to GL Responsibility.

Save.

Oracle Inventory Setup Steps:

- Define Operating Unit.

- Define Inventory Organizations

- Define Items

Define Operating Unit:

See my blog how to define Operating unit in R12.

Define Inventory Organization:

Navigation: Inventory --> Setup --> Organizations --> Organizations.

Click on New.

Enter information in the required fields.

Save your work and click on othres.

click on Accounting information.

Enter the required information and save.

Click on Others and select the inventory information.

Under Inventory Parameters tab enter the following information.

Under Costing Information tab enter the following information.

Under Revision and Lot Serial And LPN enter the required information.

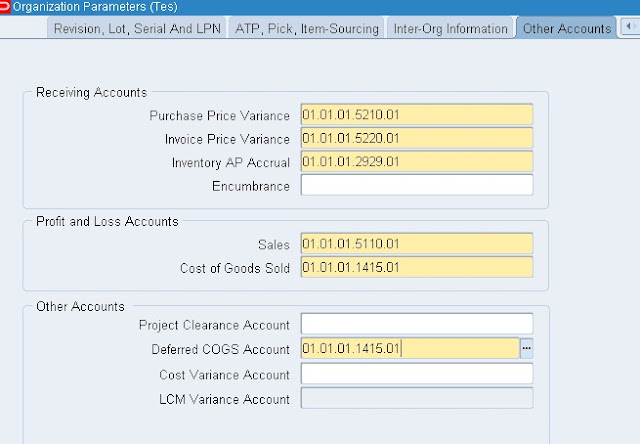

Under the other accounts tab enter the required information.

Save your work.

Under the other accounts tab enter the required information.

Save your work.

Define Items:

Navigation: Inventory --> Items --> Master items.

Enter the name and description.

Go to Tolls and click on copy from.

Enter Finished good and then click on Apply and done button.

Receivable Setups:

- Define System Options

- Define Transaction Flexfield Structure

- Define Sales Tax Location Flexfield Structure

- Define AutoCash Rule Sets

- Define Receivables Lookups

- Define Invoice Line Ordering Rules

- Define Grouping Rules

- Define Application Rule Sets

- Define Payment Terms

- Define AutoAccounting

- Open or Close Accounting Periods

- Define Transaction Types

- Define Transaction Sources

- Define Collectors

- Define Approval Limits

- Define Remittance Banks

- Define Receivables Activities

- Define Receipt Classes

- Define Receipt Sources

- Define Payment Methods

- Define Statement Cycles

- Define System Profile Options

- Define Salespersons

- Define Customer Profile Classes

- Define Customers

- Define Remit–To Addresses

Define System Options:

Define your accounting, discount, tax, and invoice system options to control how Receivables works. System options determine your accounting method, set of books, accounting flexfields, whether you use header or line–level rounding, and control the default operation of the AutoInvoice and Automatic Receipt programs.

System options also control how Receivables calculates tax on your transactions. You must specify a tax method, choose a Location Flexfield Structure, indicate whether to compound tax, select the address validation to use, and define tax defaults and rounding options. As you can set up your system to calculate Sales Tax, Value Added Tax, or Canadian Tax, we recommend that you carefully review the appropriate implementing tax essay before defining your system options.

System options also control how Receivables calculates tax on your transactions. You must specify a tax method, choose a Location Flexfield Structure, indicate whether to compound tax, select the address validation to use, and define tax defaults and rounding options. As you can set up your system to calculate Sales Tax, Value Added Tax, or Canadian Tax, we recommend that you carefully review the appropriate implementing tax essay before defining your system options.

Navigation: Receivables --> Setups --> System --> System Options.

Enter the required information in respective fields.

Define Transaction Flexfield Structure:

Transaction flexfields are descriptive flexfields that AutoInvoice uses to identify transactions and transaction lines. Receivables lets you determine how you want to build your transaction flexfield structure and what information you want to capture.

There are four types of transaction flexfields:

• Line Transaction Flexfield

• Reference Transaction Flexfield

• Link–To Transaction Flexfield

• Invoice Transaction Flexfield

You must define the Line Transaction Flexfield if you use AutoInvoice. You can use the Line Transaction Flexfield to reference and link to other lines because the Line Transaction Flexfield is unique for each

transaction line. AutoInvoice always uses the Line Transaction Flexfield structure for both the Link–to and Reference information when importing invoices. You must explicitly define the Link–to, Reference,

and Invoice Transaction Flexfield structures only if this information is to be displayed on a custom window.

Receivables gives you the option of displaying Invoice Transaction Flexfield information in the reference column of invoice lists of values.

transaction line. AutoInvoice always uses the Line Transaction Flexfield structure for both the Link–to and Reference information when importing invoices. You must explicitly define the Link–to, Reference,

and Invoice Transaction Flexfield structures only if this information is to be displayed on a custom window.

Receivables gives you the option of displaying Invoice Transaction Flexfield information in the reference column of invoice lists of values.

Use the System Profile Option AR: Transaction Flexfield QuickPick Attribute to select the Invoice Transaction Flexfield segment that you want to display. For example, if you want to be able to reference the

order number for imported invoices when using an invoice list of values, you must assign the transaction flexfield segment that holds the order number to the AR: Transaction Flexfield QuickPick Attribute

profile option. The order number will now display in the reference column of invoice lists of values.

order number for imported invoices when using an invoice list of values, you must assign the transaction flexfield segment that holds the order number to the AR: Transaction Flexfield QuickPick Attribute

profile option. The order number will now display in the reference column of invoice lists of values.

Line Transaction Flexfield:

Use columns INTERFACE_LINE_ATTRIBUTE1–15 and INTERFACE_LINE_CONTEXT to define the Line Transaction Flexfield. Line Transaction Flexfields are unique for each record in the interface table and therefore can be used as record identifiers.

Reference Transaction Flexfield:

Reference Transaction Flexfields have the same structure as the Line Transaction Flexfields.

Transactions 4 – 235 Reference Transaction Flexfields are used to apply a credit memo to an invoice or associate an invoice to a specific commitment.

Reference Transaction Flexfields have the same structure as the Line Transaction Flexfields.

Transactions 4 – 235 Reference Transaction Flexfields are used to apply a credit memo to an invoice or associate an invoice to a specific commitment.

For example, to refer a credit memo to a specific invoice, use the REFERENCE_LINE_ATTRIBUTE1–15 and REFERENCE_LINE_CONTEXT columns of the credit memo to enter the Line Transaction Flexfield of the invoice. To refer an invoice to a specific commitment, use the REFERENCE_LINE_ATTRIBUTE1–15 and REFERENCE_LINE_CONTEXT columns of the invoice to enter the Line Transaction Flexfield of the commitment.

Link–To Transaction Flexfield:

Link–To Transaction Flexfields also have the same structure as the Line Transaction Flexfield. Use Link–To Transaction Flexfields to link transaction lines together in the interface table. For example, you might want to import tax and freight charges that are associated with specific transaction lines. If you want to associate a specific tax line with a specific transaction line, use the LINK_TO_LINE_ATTRIBUTE1–15 and LINK_TO_LINE_CONTEXT columns of the tax line to enter the Line Transaction Flexfield of the invoice.

Invoice Transaction Flexfields:

Create a new flexfield with a similar structure as the Line Transaction Flexfield, but only include header level segments. For example, if the Line Transaction Flexfield structure has four segments and the last two segments contain line level information, define your Invoice Transaction Flexfield using the first two segments only. Segments included in the Invoice Transaction Flexfield should be included in the AutoInvoice grouping rules.

Create a new flexfield with a similar structure as the Line Transaction Flexfield, but only include header level segments. For example, if the Line Transaction Flexfield structure has four segments and the last two segments contain line level information, define your Invoice Transaction Flexfield using the first two segments only. Segments included in the Invoice Transaction Flexfield should be included in the AutoInvoice grouping rules.

Define Sales Tax Location Flexfield:

Receivables uses the customer shipping address to determine the sales tax rate on transactions for all customers in the country that you define in the Systems Option window as your home country. Proceed to the next step if you are not charging your customers tax based on their shipping address.

Following are the seeded Sales Tax Location Flexfield structures:

• Country

• State and City

• Province and City

• City

• Province

• State, County and City

• Country

• State and City

• Province and City

• City

• Province

• State, County and City

Use the Key Flexfield Segments window to select the seeded Sales Tax Location Flexfield structure, or to set up a new structure, that you want Receivables to use to determine your sales tax rates and to validate

your customer addresses.

You can confirm that the required segments are enabled by navigating to the Segments Summary window. Navigate back to the Key Flexfield Segments window to freeze your flexfield structure by checking the

Freeze Flexfield Definition check box and then compiling the flexfield.

your customer addresses.

You can confirm that the required segments are enabled by navigating to the Segments Summary window. Navigate back to the Key Flexfield Segments window to freeze your flexfield structure by checking the

Freeze Flexfield Definition check box and then compiling the flexfield.

Note: When you define tax system options in the System Options window, use the list of values in the Location Flexfield Structure field to select the same Sales Tax Location Flexfield structure that you selected in the Key Flexfield Segments window.

Navigation: Receivables --> Setup --> Financials --> Flexfield --> Key --> Segments.

Query with Sales Tax Location Flexfield

Enter the required information in respective filelds.

Save your work.

Like wise we can define other sales tax location flexfields,

Define AutoCash Rule Sets:

If you are using AutoCash, define your AutoCash rule sets before defining system parameters or customer profiles classes. AutoCash rules determine the sequence of application methods Receivables uses when applying receipts imported using AutoLockbox to open debit items.

Navigation: Receivables --> Setup --> Receipts --> Autocash rule sets.

Define Receivables Lookups:

Receivables provides several default lookups which are used throughout the application to provide validated default values and list of values choices. You can add or update these to customize your list of values and speed data entry. For example, you can define additional reasons for creating credit memos or enter the names of each freight carrier used by your business.

Navigation: Receivables --> Setup --> System --> Quickcodes --> Receivables.

Define lookups as you like.

Define Invoice Line Ordering Rules:

If you are using AutoInvoice, define invoice line ordering rules to specify how you want to order and number transaction lines after AutoInvoice groups them into invoices, debit memos, and credit memos. Receivables provides many attributes that you can use to define your line ordering rules.

Navigation: Receivables --> Setup --> Transactions --> Autoinvoice --> Line Ordering rule.

Define Grouping Rules:

If you are using AutoInvoice, define grouping rules to indicate how you want to group transaction lines imported by AutoInvoice. For example, to include specific transaction lines on a single transaction, certain attributes must be identical. Receivables provides many attributes that you can use to define your grouping rules.

Navigation: Receivables --> Setup --> Transactions --> Autoinvoice --> Grouping Rule.

Define Application Rule Sets:

Define Application Rule Sets to control how Receivables reduces the balance due for your open debit items when you apply payments using either the Applications window or Post QuickCash. You can define your own application rule sets, assign them to transaction types, and specify a default rule set in the System Options window.

Navigation: Receivables --> Setup --> Receipts --> Application Rule sets.

Define Payment Terms:

Define payment terms to determine the payment schedule and discount information for customer invoices, debit memos, and deposits. You can also define proxima payment terms to pay regular expenses such as telephone bills and credit card bills that occur on the same day each month and create split payment terms for invoice installments that have different due dates.

Navigation: Receivables --> Setup --> Transactions --> Payment terms.

Define AutoAccounting:

Define AutoAccounting to specify the general ledger accounts for transactions that you enter manually or import using AutoInvoice. AutoAccounting uses this information to create the default revenue, receivable, freight, tax, unearned revenue, unbilled receivable, finance charges, bills receivable accounts, and AutoInvoice clearing (suspense) accounts.

Navigation: Receivable --> Setup --> Transactions --> Auto Accounting.

Like wise we should also define reaming auto accounting types.

Open or Close Accounting Periods:

Navigation: Receivables --> Control --> Accounting --> Open/Close Periods.

Define Transaction Types:

Define the transaction types that you assign to invoices, debit memos, commitments, chargebacks, credit memos, on–account credits, and bills receivable. Receivables uses transaction types to default payment term,

account, tax, freight, creation sign, posting, and receivables information. Receivables provides two predefined transaction types: Invoice and Credit Memo.

account, tax, freight, creation sign, posting, and receivables information. Receivables provides two predefined transaction types: Invoice and Credit Memo.

Navigation: Receivables --> Setup --> Transaction --> Transaction Types.

Define Transaction Sources:

Define the transaction sources that you assign to invoices, debit memos, commitments, credit memos, on–account credits, and bills receivable. Receivables uses transaction sources to control your transaction and transaction batch numbering, provide default transaction types for transactions in batch, and to select validation options for imported transactions. Receivables provides the following predefined transaction sources: MANUAL–OTHER, DM Reversal, and Chargeback.

Navigation: Receivables --> Setup --> Transaction --> Sources.

Define Collectors:

Define collectors to assign to your customers through credit profile class assignments. Collectors can use the Collections windows and Receivables collection reports to keep apprised of a customer’s past due items. Receivables provides a predefined collector called DEFAULT.

Navigation: Receivables --> Setup --> Collections --> Collectors.

Define Approval Limits:

Define approval limits to determine whether a Receivables user can approve adjustments or credit memo requests. You define approval limits by document type, dollar amount, reason code, and currency.

Approval limits affect the Adjustments, Submit AutoAdjustments, and Approve Adjustments windows as well as the Credit Memo Request Workflow.

Navigation: Receivables --> Setup --> Transactions --> Approval Limits.

Define Remittance Banks:

Proceed to the next step if you already defined your remittance banks in Oracle Payables. Define all of the banks and bank accounts you use to remit your payments. You can define as many banks and bank accounts as you need and define multiple currency bank accounts to accept payments in more than one currency.

Define Receivables Activities

Define Receivables Activities to provide default accounting information when you create adjustments, discounts, finance charges, miscellaneous cash transactions, and bills receivable. Receivables also uses Receivables Activities to account for tax if you calculate tax on these activities.

Navigation: Receivables --> Setup --> Receipts --> Receivable Activities.

Like wise we should define reaming receivable actives also.

Define Receipt Classes:

Define receipt classes to specify whether receipts are created manually or automatically. For manual receipts, you can specify whether to automatically remit it to the bank and/or clear your accounts. For automatic receipts, you can specify a remittance and clearance method, and whether receipts using this class require confirmation.

Navigation: Receivables --> Setup --> Receipts --> Receipts Class.

Click on Bank accounts.

Enter information in respective fields.

Save your work.

Define Payment Method:

Define the payment methods to account for your receipt entries and applications and to determine a customer’s remittance bank information. When defining payment methods, you must enter a receipt class, remittance bank information, and the accounts associated with your payment receivables type. You can also specify accounts for confirmation, remittance, factoring, bank charges, and short–term debt.

Navigation: Receivables --> Setup --> Receipts --> Receipts Class.

Define Statement Cycles:

Define statement cycles to control when you create customer statements. You assign statement cycles to customers in the Customer Profile Classes window.

Navigation: Receivables --> Setup --> Print --> Statement Cycle.

Define profile options:

Define profile options to provide default values for some Receivables operations, specify how Receivables processes data, and control which actions users can perform.

Navigation: Administrator --> Profile --> Systems.

During your implementation, you set a value for each Receivables user profile option to specify how Receivables controls access to and processes data. Receivables lets you govern the behavior of many of

the windows that use profile options.

Profile options can be set at the following levels:

• Site: This is the lowest profile level. Site level profile option values affect the way all applications run at a given site.

• Application: These profile option values affect the way a given application runs.

• Responsibility: These profile option values affect the way applications run for all users of a given responsibility.

• User: These profile option values affect the way applications run for a specific application user. The values you enter for options at the User level supersede the values that your system administrator has entered for you for these options.

Each of these user profile options affect the behavior of Receivables in different contexts. In Receivables, operations that profile options can affect include receipt application, the entry of adjustments, the creation

and remittance of automatic receipts and taxes, and posting to your general ledger.

You may also have additional user profile options on your system that are specific to applications other than Receivables.

To change profile options at the Site, Application, or Responsibility level, choose the System Administrator responsibility, then navigate to the Personal Profile Values window. Query the Profile Name field to

display the profile options with their current settings, make your changes, then save your work. You can change profile options at the user level in the Personal Profile Values window. To do this, navigate to the Personal Profile Values window, query the profile option to change, enter a new User Value, then save your work. Generally, your system administrator sets and updates profile values at each level.

Attention: For any changes that you make to profile options to take effect, you must either exit, and then reenter Receivables, or switch responsibilities.

Define Salespersons:

Define salespersons to allocate sales credits to invoices, debit memos, and commitments. If you do not want to assign sales credits for a transaction, you can enter No Sales Credit. If AutoAccounting depends on salesperson, Receivables uses the general ledger accounts that you enter for each salesperson along with your AutoAccounting rules to determine the default revenue, freight, and receivable accounts for transactions.

Define Customer Profile Classes:

Define customer profile classes to categorize customers based on credit, payment terms, statement cycle, automatic receipt, finance charge, dunning, and invoicing information. When you initially set up your customers, you assign each customer to a profile class. To customize the profile class for a specific customer, use the Customer Profile Classes window.

Navigation: Receivables --> Customers --> Profile Classes.

In Profile Class window enter the following information.

In Profile class Amount tab enter the following information.

Save your work.

Define Customers:

Define customers and customer site uses to enter transactions and receipts in Receivables. When you enter a new customer, you must enter the customer’s name, profile class and number (if automatic customer numbering is set to No). You can optionally enter customer addresses, contacts, site uses and telephone numbers. You must enter all the components of your chosen Sales Tax Location Flexfield when entering customer addresses in your home country.

Navigation: Receivables --> Customers --> Standard.

Define Remit–To Addresses:

Define remit–to addresses to inform your customers where to send payments. Associate each remit–to address with one or more state, country, and postal code combinations.

For example, if you want your customers in California and Nevada to send their payments to a specific address, enter the remit–to address and associate the states CA and NV with this address. Remit–to addresses are assigned based on the bill–to address on the transaction.

Navigation: Setup --> Print --> Remit-to-addresses.

Click on Create Remit to addresses.

Enter the required information

Click on Apply.

Enter the country name in the same page and then click on the GO.

Click on the Receipts form Create button.

Enter the following information and click on Apply button.

Hi Kumari,

ReplyDeleteNow you can subscribe my site update via email.

Regards,

Raju.

how to subscribe \

ReplyDeletehelp me also

Regards

Murugesh

Amazing info, thanks for sharing

ReplyDeleteDetailed info, thanks for sharing. Would you let me know how to subscribe ur blog?

ReplyDeletePlease send me your email id i will add to my circle.

DeleteI would like to subscribe..........My Email ID is nnnaveed123@gmail.com

DeletePlease add me too.... vpikrampatel@gmail.com

DeleteHi Lakshmi,

ReplyDeletePlease send me your email id i will add to my circle.

Appreciate your efforts to put in all details of setups. Excellent stuff

ReplyDeleteThanks for your comment.

DeleteGood work Raju.

ReplyDeleteHave you published similar setup for AP as well? If so then please let me know.

Many Thanks

Hi Ghulam,

DeleteYes i have published setups for AP as well.

Please go through below link then we can find setups for payabels.

http://orafinappssetups.blogspot.in/2012/11/mandatory-setups-for-payables_21.html

Regards,

Raju

your blog is greatest information provided for me..thank you

ReplyDeleteFCA regulation|FCA application

Hi Ramji,

DeleteThanks for your comment.

Regards,

Raju

HAI RADHA

ReplyDeleteGOOD WORK

it is the great information for the fca thank you...thank you for sharing..

ReplyDeleteFCA application|Financial regulation.

cool

ReplyDeleteHey I’m Martin Reed,if you are ready to get a loan contact.Mr Benjamin via email: lfdsloans@lemeridianfds.com,WhatsApp:+1 989-394-3740 I’m giving credit to Le_Meridian Funding Service .They grant me the sum 2,000,000.00 Euro. within 5 working days. Le_Meridian Funding Service is a group investors into pure loan and debt financing at the returns of 1.9% to pay off your bills or buy a home Or Increase your Business. please I advise everyone out there who are in need of loan and can be reliable, trusted and capable of repaying back at the due time of funds.

ReplyDelete

ReplyDeleteBEST WAY TO HAVE GOOD AMOUNT TO START A GOOD BUSINESS or TO START LIVING A GOOD LIFE….. Hack and take money directly from any ATM Machine Vault with the use of ATM Programmed Card which runs in automatic mode. email (williamshackers@hotmail.com) for how to get it and its cost . ………. EXPLANATION OF HOW THESE CARD WORKS………. You just slot in these card into any ATM Machine and it will automatically bring up a MENU of 1st VAULT $1,000, 2nd VAULT $2,000, RE-PROGRAMMED, EXIT, CANCEL. Just click on either of the VAULTS, and it will take you to another SUB-MENU of ALL, OTHERS, EXIT, CANCEL. Just click on others and type in the amount you wish to withdraw from the ATM and you have it cashed instantly… Done. ***NOTE: DON’T EVER MAKE THE MISTAKE OF CLICKING THE “ALL” OPTION. BECAUSE IT WILL TAKE OUT ALL THE AMOUNT OF THE SELECTED VAULT. email (williamshackers@hotmail.com) We are located in USA.

I got my already programmed and blanked ATM card to withdraw the maximum of $1,000 daily for a maximum of 20 days. I am so happy about this because i got mine last week and I have used it to get $20,000. Mike Fisher Hackers is giving out the card just to help the poor and needy though it is illegal but it is something nice and he is not like other scam pretending to have the blank ATM cards. And no one gets caught when using the card. get yours from Mike Fisher Hackers today! *email cyberhackingcompany@gmail.com

ReplyDeleteNon-Resident Banking in South Africa | Global Immigration Africa - GIA™ Bank Account Setup | Are you planning to invest, visit or emigrate from South Africa? We can assist you with everything from international money transfers to setting up accounts and investments. Contact GIA: admin@globalimmigrationafrica.co.za

ReplyDeleteFor more information visit here : Non-Resident Banking in South Africa

Remarkable article, it is particularly useful! I quietly began in this, and I'm becoming more acquainted with it better! Delights, keep doing more and extra impressive! Vattenskärning

ReplyDeleteThank you because you have been willing to share information with us. we will always appreciate all you have done here because I know you are very concerned with our. millionare dating

ReplyDeleteCONTACT 24/7

ReplyDeleteTelegram > @leadsupplier

ICQ > 752822040

Email > leads.sellers1212@gmail.com

Selling SSN+Dob Leads/Fullz with Driving License/ID Number For Tax return & W-2 Form filling, etc.

>>1$ each without DL/ID number

>>2$ each with DL

>>5$ each for premium (also included relative info)

Price reduce in Bulk order

DETAILS IN LEADs/FULLZ/PROS

->FULL NAME

->SSN

->DATE OF BIRTH

->DRIVING LICENSE NUMBER WITH EXPIRY DATE

->COMPLETE ADDRESS

->PHONE NUMBER, EMAIL, I.P ADDRESS

->EMPLOYMENT DETAILS

->REALTIONSHIP DETAILS

->MORTGAGE INFO

->BANK ACCOUNT DETAILS

>All Leads are Spammed & Verified.

>Fresh spammed data of USA Credit Bureau

>Good credit Scores, 700 minimum scores

>Invalid info found, will be replaced.

>Payment mode BTC, ETH, LTC, PayPal, USDT & PERFECT MONEY

''OTHER GADGETS PROVIDING''

>SSN+DOB Fullz

>CC with CVV

>Photo ID's

>Dead Fullz

>Carding Tutorials

>Hacking Tutorials

>SMTP Linux Root

>DUMPS with pins track 1 and 2

>Sock Tools

>Server I.P's

>HQ Emails with passwords

Contact 24/7

Email > leads.sellers1212@gmail.com

Telegram > @leadsupplier

ICQ > 752822040

CONTACT 24/7

ReplyDeleteTelegram > @leadsupplier

ICQ > 752822040

Email > leads.sellers1212@gmail.com

Selling SSN+Dob Leads/Fullz with Driving License/ID Number For Tax return & W-2 Form filling, etc.

>>1$ each without DL/ID number

>>2$ each with DL

>>5$ each for premium (also included relative info)

Price reduce in Bulk order

DETAILS IN LEADs/FULLZ/PROS

->FULL NAME

->SSN

->DATE OF BIRTH

->DRIVING LICENSE NUMBER WITH EXPIRY DATE

->COMPLETE ADDRESS

->PHONE NUMBER, EMAIL, I.P ADDRESS

->EMPLOYMENT DETAILS

->REALTIONSHIP DETAILS

->MORTGAGE INFO

->BANK ACCOUNT DETAILS

>All Leads are Spammed & Verified.

>Fresh spammed data of USA Credit Bureau

>Good credit Scores, 700 minimum scores

>Invalid info found, will be replaced.

>Payment mode BTC, ETH, LTC, PayPal, USDT & PERFECT MONEY

''OTHER GADGETS PROVIDING''

>SSN+DOB Fullz

>CC with CVV

>Photo ID's

>Dead Fullz

>Carding Tutorials

>Hacking Tutorials

>SMTP Linux Root

>DUMPS with pins track 1 and 2

>Sock Tools

>Server I.P's

>HQ Emails with passwords

Contact 24/7

Email > leads.sellers1212@gmail.com

Telegram > @leadsupplier

ICQ > 752822040

Howdy! Do you know if they make any plugins to help with SEO? I'm trying to get my blog to rank for some targeted keywords but I'm not seeing very good success. If you know of any please share. Kudos! Personalized Mortgage Solutions

ReplyDeleteI was searching for loan to sort out my bills& debts, then i saw comments about Blank ATM Credit Card that can be hacked to withdraw money from any ATM machines around you . I doubted thus but decided to give it a try by contacting (smithhackingcompanyltd@gmail.com} they responded with their guidelines on how the card works. I was assured that the card can withdraw $5,000 instant per day & was credited with$50,000,000.00 so i requested for one & paid the delivery fee to obtain the card, after 24 hours later, i was shock to see the UPS agent in my resident with a parcel{card} i signed and went back inside and confirmed the card work's after the agent left. This is no doubts because i have the card & has made used of the card. This hackers are USA based hackers set out to help people with financial freedom!! Contact these email if you wants to get rich with this Via: smithhackingcompanyltd@gmail.com or WhatsApp +1(360)6370612

ReplyDeleteWhen I originally left a comment I seem to have clicked the -Notify me when new comments are added- checkbox and now every time a comment is added I recieve four emails with the exact same comment. There has to be a way you can remove me from that service? Thanks! anonymous chat

ReplyDeleteThanks , I’ve recently been looking for information about this subject for ages and yours is the greatest I have came upon so far. But, what concerning the conclusion? Are you sure concerning the source? anonymous chat

ReplyDeleteWhoa! This blog looks exactly like my old one! It’s on a totally different topic but it has pretty much the same page layout and design. Wonderful choice of colors! pasikuda beach sri lanka

ReplyDeleteYou can read this Fixed Deposits vs Bonds Investment in India now as well Buy Bonds in India

ReplyDeleteYou can read this Investment in Fixed Deposits vs Bonds in India now as well Buy Bonds in India

ReplyDeleteYou can read this Fixed Deposits or Bonds Investment now as well Buy Bonds in India

ReplyDeleteYou can read this Where to invest Fixed Deposit or Bonds now as well Buy Bonds in India

ReplyDeleteThe information mentioned in this blog quite understands. I just recommend everyone follow the prompts for the why is my cash app payment failing. Still, if you find any difficulty, you make seek quick assistance from the cash app desk. We make you understand how to send and receive money without a problem using our support.

ReplyDeleteInitially, I was much tensed about How to access old cash app account? Then, I get over this BLOG & found it helpful. This blog helps me out with all juggling problems. Still, if you don’t find out useful, give a try to cash app desk. If a potentially fraudulent payment occurs, the cash app desk will cancel it to prevent you from being charged. visit site: www.cashappdesk.com

ReplyDeleteI found this BLOG informative which helps better assistance to cash app transfer failed. So, Do you need to know the reasons of the same i.e., Daily limit on cash app Then, check out the official website of cash app desk. We provide accurate information to all our clients. The team specifically works thoroughly to provide seamless informative contents. Also, we are responsible for boosting the client's engagement.To know more, visit us at: www.cashappdesk.com

ReplyDeleteDo you Need Instant Loan from $2,000 to $50,000,000.00 with no collateral required and receive a no obligation loan approval.We welcome the opportunity to show you how effective we are at helping our clients obtain the money they need to succeed. Our professional staff is available for a Free Consultation.At Patiala legitimate company Pvt , contact us now 2% interest rate, both long and short term cash reply to us (Whats App) number: +919394133968 patialalegitimate515@gmail.com

ReplyDeleteMr Jeffery

Great article. Couldn’t be write much better! Keep it up! what is recurring deposit

ReplyDeleteThis blog contain very interesting information and also helpful, thanks for sharing such a good content, but some users may be search terms like transfer failed cash app, and they don't find the relevant information.

ReplyDeleteI read your article and then I read through some of the comments other people made. I agree with your article content and with many of the comments on here. You are a good writer.

ReplyDeleteaccount receivable management service

Transportation management system is a logistics platform that uses technology to help business plan, execution and optimize the physical movement of the goods. Thanks for your blog.

ReplyDeletefreight tracking software

Fake Food Receipts | Fast Food Receipts | Restaurant receipts

ReplyDeleteFood Receipts maker, using which can generate lunch or dinner or breakfst food receipts. Can support maximum customize

For More Info:- free receipt maker

Nice Post!!

ReplyDeletePlease look here at Invoice Management System

Please look here at Freight Invoice Management Services

ReplyDeleteI cannot thank you enough for the blog.Thanks Again. Keep writing.

ReplyDeleteSAP PP online training in hyderabad

SAP PP module free online training

fbdi template oracle

ReplyDeleteUsers of Oracle Fusion Procurement can utilize Simplified Loader's Excel Templates to ... Please review a detailed comparison with FBDI Template here.

to get more -

https://simplifiedloader.com/Catalogue/oracle_fusion_purchase_order_excel

Thanks for the information and tips. Please include easy loans australia . I would appreciate it greatly.

ReplyDeleteAssuming I say that there is a charge card you can tweak all alone and connect to your ledger and which is acknowledged at practically every one of the stores in the USA? Then, at that point, you may not trust this. Be that as it may, to be sure Cash App gives its clients a free check card which you should attempt once. So assuming that you are exhausted with your standard charge card

ReplyDeleteYou might be keen on the Cash App's check card. Be that as it may, to get every one of the advantages of a cash app charge, you should figure out how to activate cash app card.

Mango Credit want to positively impact the business or personal borrower they financing. It’s therefore important for them to understand what the funds are being used for, to ensure that the most appropriate loan and term are provided. Also they provide instant loan

ReplyDeleteIf you haven't looked at credit card processing and a merchant accounts recently, you owe it to yourself and your business to look at them today. North American Bancard Agent Program

ReplyDeleteFake Receipt Generator

ReplyDeleteThe best free online tool to create fake restaurant receipts, hotel receipts, and more! This fake receipt generator is a free downloadable software that allow you to create an invoice for any kind of business.

For More Info:- Fake receipt generator

ReplyDeleteThanks for sharing informative blog, I was much tensed about How to track Cash App Card Then, I get over this BLOG and found it helpful. This blog helps me out with all juggling problems. Still, if you don’t find out useful, give a try to cash app desk. If a potentially fraudulent payment occurs, the cash app desk will cancel it to prevent.To know more, visit us at: www.cashappassist.com

I am a living testimony of change. I can safely say that i have been blessed and my life transformed from being just a company attendant to a business owner all in the space of 1 month after i got my return on investment from davidbenjaminexptrader@outlook.com I did try some other trader but i got scammed. I am using this medium to reach out to the world for those who got plans to go bigger and better in life to contact this company via davidbenjaminexptrader@outlook.com or on WhatsApp +1 408 500 0775

ReplyDeleteasap for certified and trusted services.

advantages of recurring deposit

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThanks For Sharing. Especia is one of the leading CA Firms In India. We provide Accounting Services, CFO Services, ESOP Services, Company Secretarial Services, Accounts Receivable Services, etc. Accounts receivable services help a company to seamlessly deal with their financial matters such as their accounting which helps in easy generation and cash flow in the company. These services make quicker payment easily accessible providing high income. Account Receivable Service is one of the most important functions which involves the flow of money into a company. if you need Accounts Receivable Services call at 9310165114 or visit us Accounts Receivable Services

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteHi,

ReplyDeleteYour blog is amazing. You have provided so much details about accounting, finance, first party collection services and account receivables. I enjoyed reading it so much. Thanks for your efforts.

Blog information is veru good and thanks for sharing this blog but Cash App is a mobile payment app that allows you to send and receive money from your friends and family via the app on their mobile. How To Receive Money From Cash App Getting money on Cash App is very easy and here’s what you need to follow to avoid any problems while receiving money from a sender on Cash App. Visit site www.cashappassist.com

ReplyDeleteThis blog is really helpful for me as I looking for invoice factoring services in the UK. Thanks for sharing it.

ReplyDeleteNone Recourse Factoring

Hi,

ReplyDeleteYour blog is amazing. You have provided so much details about accounting, finance, first party collections and account receivable recovery services. I enjoyed reading it so much. Thanks for your efforts.

Seeking professional part-time accounting services in Surat? Look no further! Our experienced accountants offer top-notch expertise to manage your financial needs. From bookkeeping to financial analysis, we've got you covered. Streamline your business finances with our reliable part-time accountant service in Surat.

ReplyDeleteAccounts receivable or AR are the unpaid bills or invoices a company has sent to its customers in the simplest sense.

ReplyDelete